We are the leading SME lending platform in the UK

£16bn financed to date

£84bn addressable SME loans market

110,000+ SMEs financed on the platform

15 year track record

>87,000 jobs created and sustained in 2024 in the UK

We are the leading SME lending platform in the UK

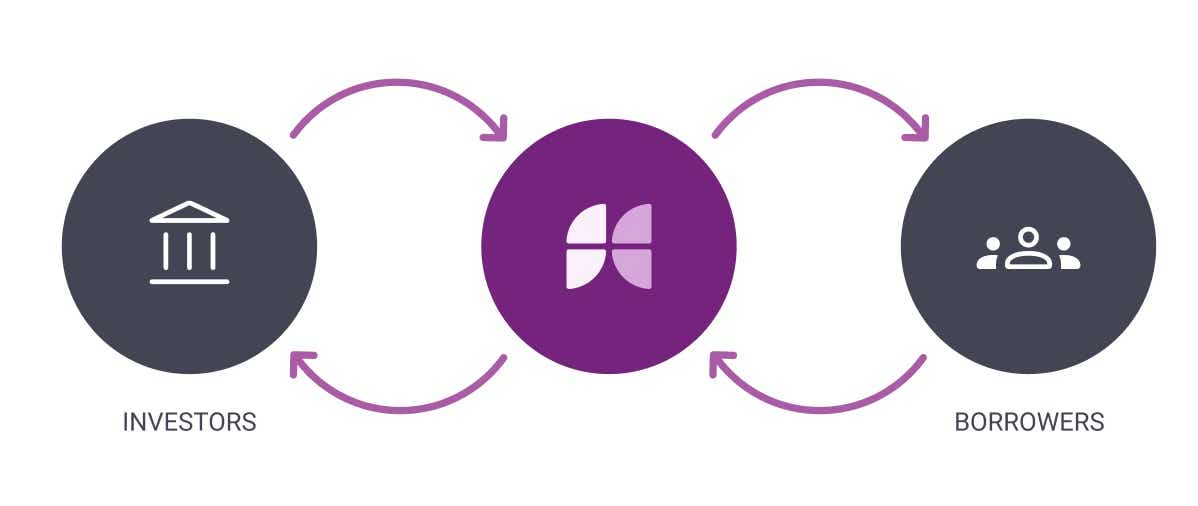

We connect businesses looking to borrow with investors who want to lend. So far investors have financed the ambitions of over 110,000 businesses in the UK.

Our platform gives institutional investors access to small business loans, an asset class historically the domain of commercial bank balance sheets. We leverage the latest technology to streamline processes, delivering fast, efficient service to borrowers, and attractive returns to investors. We believe it’s a better system for everyone.

View our Funding Circle Overview presentation for more information on what we do and how you can invest.

Meet the team

Funding Circle’s leadership team has extensive experience and a strong track record.

Chief Executive Officer

Chief Financial Officer

Chief Risk Officer

Chief Technology Officer

U.K. Managing Director

Company Secretary, General Counsel and Chief People Officer

Chief Capital Officer

Why invest through Funding Circle

We are the largest lending platform in the UK, with a proven track record and a well recognised brand.

Our platform facilitates access to an alternative asset class in an underserved market, and delivers both robust and attractive returns, as well as reduced cost of funding for leveraged investments. Established in 2010, and now the leading lending platform to SMEs, Funding Circle has to date provided over £16bn of loans to over 110,000 businesses in the UK. With total addressable markets for SME lending of £84bn in the UK, the opportunity is large

The business is at an exciting inflection point. High operational gearing, through scalability of our fintech platform, improves profitability and from the strong growth opportunities for the business. This is driven particularly by our medium-term strategy, which focuses on three key areas:

- Attract more businesses — by extending our lending distribution channels: including use of embedded partner solutions and Lending as a Service;

- Say yes to more businesses — by improving both SME coverage and borrower conversion: including use of our Marketplace for lending that falls outside our normal parameters; new customer segments (such as near prime UK borrowers); and improvements in process; and

- #1 in new products — leveraging the platform through a multi-product approach, including our FlexiPay product (line of credit and card).

SMEs are a key driver of communities, society and economies. Yet access to the finance they need to support their aspirations and operations is often restricted, with SMEs making up around half of UK and US GDP, but only a fraction of bank lending (<2% in our markets).

By lending to SMEs, you can help drive the real economy forward, create jobs and support communities, as well as earning robust, stable returns.

Funding Circle is a finance provider that backs small businesses. SMEs are crucial to the wider economy, supporting local communities and providing millions of jobs, yet they are often underserved by traditional finance providers. We're here to give them the access to finance they deserve.

Please see Oxford Economics - Our latest Economic Impact Report, produced in partnership with Oxford Economics, examines the vital role small businesses play in the UK economy, and how our lending supports them.

lmpact on Credit Access in the US - Research from the Bank for International Settlements (BIS) and the Federal Reserve Bank of Philadelphia shows the positive impact of fintech lending on credit access for U.S. small businesses. The Research analyses proprietary loan-level data from Funding Circle and other small business fintech data. Read our press release is here.

Our approach to Environmental, Social and Governance (“ESG”) is driven by our Global ESG Framework, with Board level oversight and executive level ESG management incentives. Our efforts focus on four key areas:

- Climate change and environment

Diversity, equity and inclusion

Social impact

Governance and risk management

For further detail please see our Sustainability page.

Get in touch with Capital Markets

To speak with someone from our investment team, please email us at capmktswebleads@fundingcircle.com