-

United Kingdom

- Sign in

Updated: 30 March 2021

Jerome Le Luel is the Global Chief Risk Officer of Funding Circle. He leads a team of more than 100 risk professionals including data scientists, risk analysts and credit assessment experts. Jerome joined Funding Circle five years ago, bringing with him more than 20 years of experience in risk management. His previous roles include Global Head of Risk Analytics at Barclays Bank and Global Chief Risk Officer at Barclaycard, where he successfully navigated their global portfolio through the 2008/9 recession.

As we mark a year since the first national lockdown was announced, there have been several encouraging signs in recent weeks. The daily Covid figures have fallen considerably, the vaccination rollout is being delivered at pace, and the Government has laid out its roadmap for reopening the country.

As a result, economic forecasts are beginning to look more positive. The Office for Budget Responsibility (OBR) now predicts the UK’s GDP will return to pre-crisis levels by the middle of next year – six months earlier than previously expected1. The forecast for unemployment has also improved, and it is now expected to peak at 6.5% at the end of this year, well below the 8.5% seen in the wake of the last recession2.

However, while the economic outlook is increasingly more positive than we previously thought, there still remains a lot of uncertainty. To help businesses, the government is continuing to provide significant financial support through its extension of the furlough scheme, a new government-backed loan scheme and other important measures.

At Funding Circle, we too will continue to be prudent in order to protect your returns and support the businesses you have lent to. Small businesses have shown incredible resilience over the last year, and in this update I’ll look at how they’ve stayed on track with their loans and how this will affect your returns. The key points include:

Throughout the pandemic, small businesses have shown their resilience and found new ways to adapt to the new environment they found themselves in.

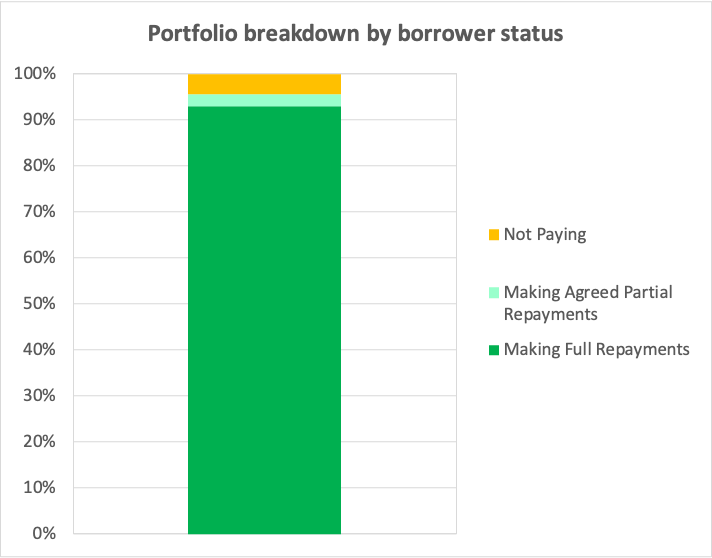

We’ve seen this clearly in the businesses you have lent to. While initially we saw more businesses get in touch to ask for payment plans, the vast majority quickly got back on their feet and began repaying as their plans came to an end. 95% are now making repayments, up from the 90% we saw in September.

The number of businesses missing a payment for the first time also fell back to pre-Covid levels, and has remained stable despite further lockdowns. This shows the character and determination of small businesses across the UK, and how they drive the economy forward when they get the right support.

In my last update, I spoke about how we used stress-test scenarios from the Bank of England and data from the previous Global Financial Crisis to estimate what the impact of the pandemic would be. As the pandemic has unfolded, we have continued to update this simulation with the latest data, and are constantly analysing how we expect the loanbook to perform in the future.

This has enabled us to estimate the projected returns for investors, under stress, by annual loan cohort. The below table shows the projected returns for loans by the year they were taken out.

It is important to note that we have always said that during a recession, depending on its severity, returns would be lower than initially predicted. However, I’m pleased to say that despite the unprecedented nature of this crisis, we still expect returns to remain positive, with some cohorts predicted to improve slightly.

| Loan Cohort | Projected Returns – Sept 20203 | New Projected Returns3 |

| 2015 | 6.9% – 6.9% | 6.6% – 6.7% |

| 2016 | 4.3% – 4.6% | 4.5% – 4.9% |

| 2017 | 2.3% – 2.8% | 2.8% – 3.3% |

| 2018 | 0.9% – 1.9% | 1.3% – 2.3% |

| 2019 | 1.2% – 2.7% | 1.2% – 2.7% |

| 2020 | 2.2% – 4.0% | 2.2% – 4.0% |

Last year when the pandemic began, we rapidly bolstered our Collections & Recoveries team and introduced a series of measures to support businesses through this period. We continue to work hard to protect your returns by monitoring and adapting our processes, helping businesses and avoiding unnecessary credit losses.

In addition, we are pleased to hear from businesses that Government support has made a huge difference. Insolvencies are at their lowest level in the past decade despite a severe recession4, and more than 80% of businesses who took a Funding Circle CBILS loan said that it prevented them from cutting investment, jobs or having to close completely.

However, with furlough extended until the end of September and the new Recovery Loan Scheme running from April until the end of the year, it is clear that much uncertainty remains and that businesses will continue to need financial support.

In this context, our modelling shows that the recovery is still only just beginning and we should remain prudent. As a result, lending from individual investors (known as retail investors) continues to remain paused until we believe conditions are right to restart it again.

As we’ve seen, small businesses have continued to show their resilience throughout this pandemic. The fact that 95% of borrowers are making repayments, and that loans becoming late are at pre-Covid levels, is a testament to the strength and adaptability of UK SMEs.

However, they continue to face significant challenges, and we’re focused on giving them the support they need to come through this pandemic and ultimately, to repay their loans.

Many businesses may have started making repayments but have not yet caught up. They will still be marked as late until they have cleared their arrears, which you’ll be able to see in your account. We will continue to work with all borrowers facing difficulties to get the best outcome for them and the investors who’ve lent to them.

With vigilance and cautious optimism, we hope that the recovery continues to gather pace and, as we continue to respond to the challenges created by the current environment, we thank you for your support.

References:

5779 REVIEWS