-

United Kingdom

- Sign in

Updated: 19 October 2021

Over the last year and a half, the impact of coronavirus has affected nearly every aspect of business life. National lockdowns brought unprecedented trading restrictions, and the demand for business finance shot up. As a result, small business owners looked to online loan providers, accelerating the adoption of digital finance.

Here we take a look at some of the key factors driving this trend, and what it means for SME finance going forward.

Early on in the pandemic, there was a significant increase in borrowing among SMEs. The vast majority of this increase was under the Bounce Back Loan Scheme (BBLS) with funds going to smaller businesses, many of whom were taking on finance for the first time to cope with the unprecedented situation.

The Coronavirus Business Interruption Loan Scheme (CBILS) largely replaced the normal levels of SME finance that we would see in the market.

Gross SME lending, 2019-2020

As a result of the pandemic, widespread trading restrictions were put in place across the country, with huge implications for every industry. With high streets shut and instructions to stay indoors, millions looked to online providers.

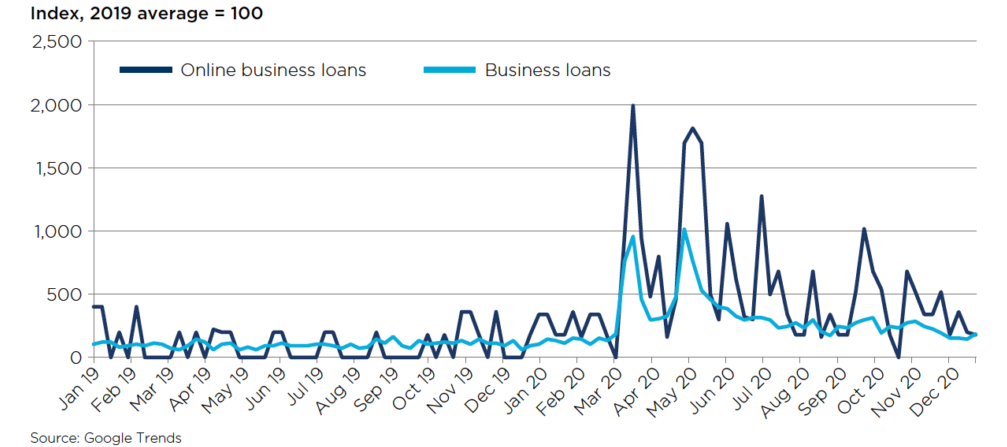

This trend accelerated the adoption of digital finance providers, with searches for ‘online business loans’ increasing by 5.3 times compared to 2019, and increasing 20 times in the week just after the Government’s Coronavirus Business Interruption Loan Scheme (CBILS) was announced.

Online searches for business loans in the UK

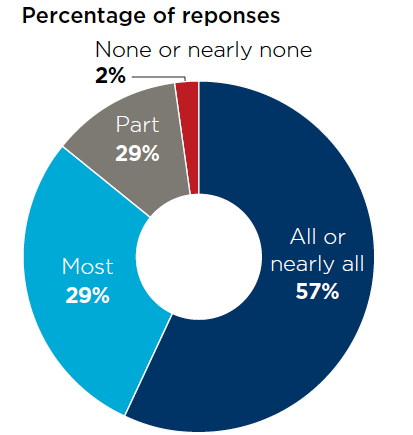

With sustained periods of uncertainty, many small business owners wanted a cash flow buffer to add a layer of protection. They didn’t necessarily want to spend their loans, but thanks to the unique features of the Government’s coronavirus loan schemes, they were able to borrow extra capital to help them adjust to the changing circumstances.

In fact, among businesses who took a CBILS loan through us, the vast majority had most or all of that buffer still in place.

How much cash buffer is still in place

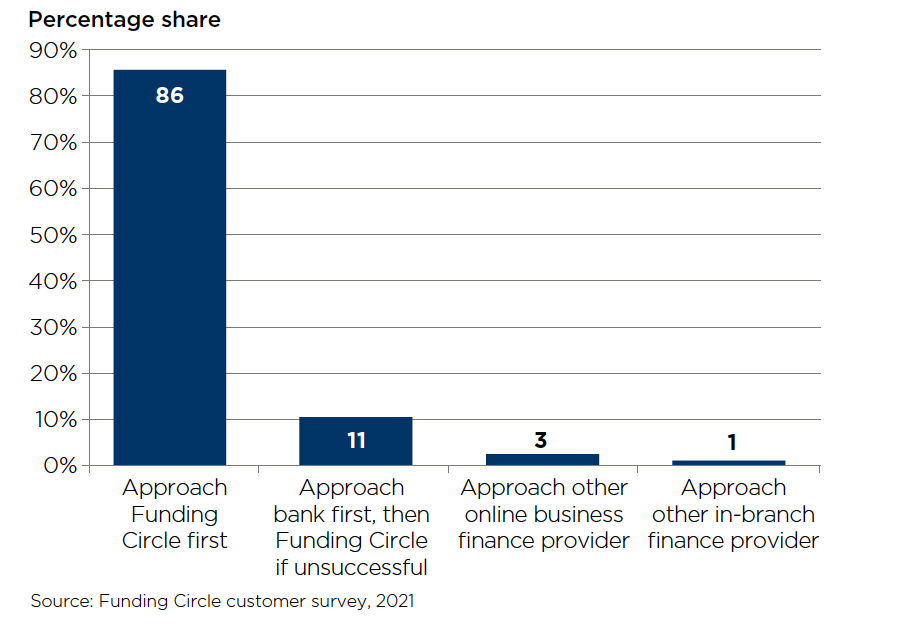

As an online provider that specialises in small business loans, we’ve seen over the last 10 years that once a business has tried online finance, typically they don’t go back to their bank. Of our new customers who took a CBILS loan, 86% said they’d come back to us first for finance over their bank.

Who would you approach next for finance?

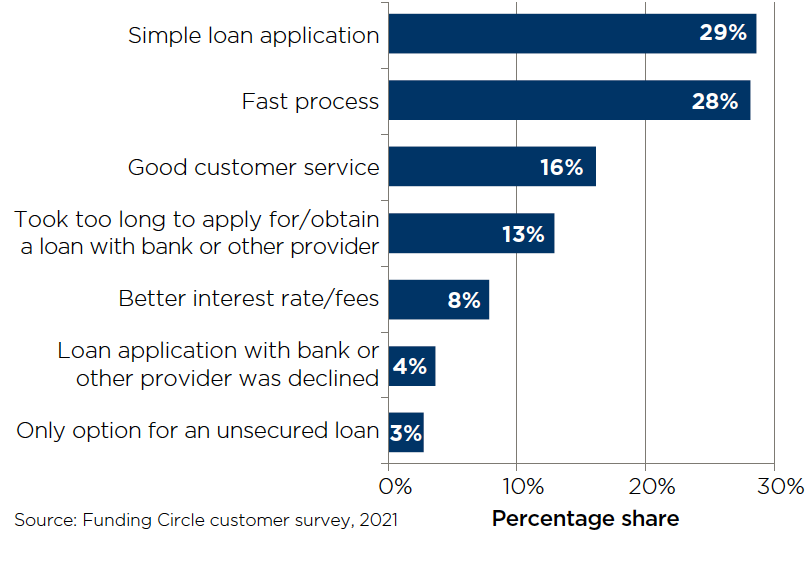

Our simple loan application and fast process are the most popular reasons that customers choose to come back to us for their future finance needs.

Main reason for borrowing through Funding Circle

As the roadmap for reopening the country continues, SMEs are already planning to expand. In a recent survey by Funding Circle and the British Chambers of Commerce, 63% of firms were confident in their growth in the next 12 months.

What’s more, 44% believe access to finance will help overcome the remaining barriers to fully restarting operations.

Unless otherwise stated, all data is from Supporting SMEs Through Crisis And Recovery – Funding Circle’s 2020 Impact – March 2021

5779 REVIEWS