Sign up for Funding Circle newsletter!

Get our latest news and information on business finance, management and growth.

Updated: March 27th, 2020

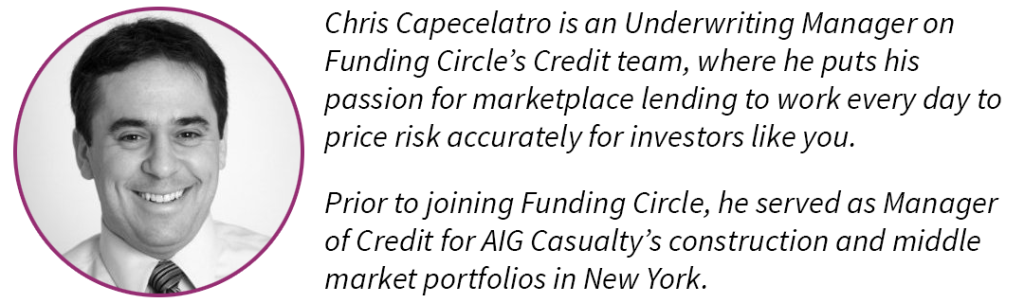

Before joining Funding Circle as an underwriter, I managed credit risk for a global casualty insurer: think big companies and even bigger ticket sizes per transaction. I’ve also worked in commercial lending for a locally-owned bank in a small town. Combined, that expertise uniquely informs my work at Funding Circle, where I’m processing transactions at scale but also optimizing for an SME customer.

One of the biggest differences between the traditional financial institutions I used to work with and Funding Circle is actually the business model: Funding Circle is a marketplace, not a balance sheet lender. Through our marketplace, we match creditworthy small businesses who need capital with investors looking for yield. Understanding the viability of your business over the long term is dependent upon the liquidity of your marketplace is a revelation for a credit professional.

With a traditional balance sheet lender, each credit risk goes onto your balance sheet and hits your bottom line in the event of a default. At Funding Circle, the ripple effect is larger — a default also dampens investor confidence in our marketplace. Being mindful of how both sides of the coin, borrowers and investors, affect our business actually makes us better underwriters.

Because we are ultimately all invested in this business, we evaluate the credit quality of each and every deal with our investor hats on to accurately assess and price risk. That’s a huge cultural difference between my team and what you’d see at a more traditional financial institution.

We analyze our borrowers using a strategic blend of internal credit models and human judgment and review, which we believe is critical to our ability to really dig into the nuances of each of the small businesses we lend to.

One of the ways that we win in our industry is by automating the more manual, time-consuming parts of our underwriting process. For instance, we have an API that auto-populates credit report information into our underwriting model. Our CRM platform and proprietary web-based underwriting tool make the entire process paperless, and the journey of an application through the origination funnel highly efficient.

We believe best way to scale our operations is to concentrate our staffing power at the decision point. To that extent, automation is a big part of the process and the future of underwriting in general, and we’re pioneering that change. But at the end of the day, we offer most of our deals only after one of our underwriters has a conversation with the applicant to make a more personally-informed decision.

I interact with the model multiple times a day — every time I look at a deal. I also work closely with the architect of that model, our Chief Risk Officer, Manpreet Dhot. Every time an underwriter makes a decision, we capture a snapshot of all the data in our model, including our own notes and calculations of financial metrics. All of that goes into a vast data warehouse where Manpreet and his team identify trends and interesting outcomes to help predict future performance or decisions.

Our first look at any deal is actually through the eyes of a more traditional banker. We look at primary, secondary, and tertiary sources of repayment — including business cash flow, personal cash flow, collateral, and personal assets that could be liquidated if necessary.

However, unlike a traditional lender, we’re not necessarily hung up on any one of those individual metrics. While we believe credit history is an important gauge of financial and operational stability, so too are alternative metrics like real-time cash flow and an owner’s passion about the market opportunity. Our philosophy — if you have a credit “box” that’s sharply defined and rigidly enforced, you miss out on good borrowers.

For consumer credit, most people know what their FICO score is or how to find it via a credit bureau. Our challenge: although many small businesses are distinct corporate entities with their own tax ID number, there is no centralized or reliable credit reporting for businesses on par with a consumer credit report.

That’s why we take the personal credit history and financial stability of the business owner into very serious consideration, and require a personal guarantee from each applicant. By triangulating between business tax returns, internal financial statements, debt sheets, banking statements, and the personal financial stability and credit record of the applicant, we are able to formulate a very accurate risk profile.

We can do all of this faster and more profitably than a bank because we have flexibility that traditional lenders just can’t match. Powered by Silicon Valley technology, our streamlined process gathers relevant information and digests it into a presentable format, freeing up our underwriters to apply their experience to the analytical demands of decision-making. That’s how the human element remains central to our underwriting.

I have been incredibly lucky to have a lot of different experiences in life, from being a professional kayaker for five years, to spending three months in the South American wilderness, to working in a sheep station in New Zealand. I’m too old to launch off waterfalls or camp on a glacier anymore so building Funding Circle from the ground up and connecting entrepreneurs with investors to help them build a remarkable business is what gets my adrenaline flowing!